Sale Would Take $3.4 Billion from Members Of Blue Cross and Give It to New Foundation

By Woody Jenkins, Editor, Central City News – Baton Rouge

Some con games are pretty sophisticated. The taking of $3.4 billion from the owners of Blue Cross/Blue Shield is not one of them. On the contrary, this slight of hand is quite simple, and it’s out in the open for anyone to see — if they bother to pay attention to what is happening.

Blue Cross is a non-profit mutual insurance company. It serves 1.9 million policy holders in Louisiana. On its website, Blue Cross says, “Blue Cross is Louisiana-owned and -operated. It is a non-profit, fully taxed, mutual company owned by its policy holders — not shareholders.”

The Board of Blue Cross has proposed selling this Louisiana company, which employs nearly 3,500 Louisiana citizens, to Elevance, a for-profit, mega-insurance company with 47 million policy holders across the nation.

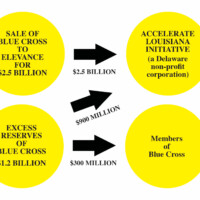

The sales price is $2.5 billion.

What is most unusual about the proposed sale is that the $2.5 billion sales price would not go to the 1.9 million policy holders of Blue Cross or to the 92,000 members with voting rights.

Rather, the $2.5 billion sales price would go to a new non-profit foundation, which was recently organized in the State of Delaware.

Earlier in the year, the Board members of Blue Cross, each of whom receive $105,000 a year for sitting on the part-time board, gave its members the option to become initial members of the Board of the new foundation, which incorporated in Delaware under the name The Accelerate Louisiana Initiative.

The articles of incorporation of Accelerate have not been available online, nor have the officers or board members been announced.

However, in testimony before the Joint Legislative Committee on Insurance, Tim Barfield, who was listed as Chairman of the Blue Cross Board of Directors, said that he is Acting Chairman of the new Accelerate foundation.

As of Sept. 21, 2023, Mr. Barfield is still listed on the Blue Cross website as a member of the Blue Cross Board of Directors.

The proposed sale of Blue Cross to Elevance is fully described in documents available on the Louisiana Department of Insurance website. One of those documents is the The Agreement and Plan of Acquisition, which is found at

https://ldi.la.gov/docs/default-source/documents/legaldocs/public-comments/plan-of-reorganization.pdf?sfvrsn=1d8f4652_0

The Agreement and Plan of Acquisition, is an agreement among three parties:

• Blue Cross/Blue Shield of Louisiana

•Elevance Health, as parent, and ATH Holding Company LLC, as purchaser

•The Accelerate Louisiana Initiative, Inc., as the foundation

Under the terms of the Agreement and Plan of Acquisition, the purchaser will pay for “the extinguishment of the membership interests of the Company held by the Eligible Members.”

In other words, Blue Cross is selling the membership interests of the members of Blue Cross.

An examination of the Plan of Acquisition shows the following:

•The sales price of $2.5 billion will be paid by Elevance’s holding company to The Accelerate Louisiana Initiative foundation.

•In addition, out of Blue Cross’ excess reserves, approximately $900 million will be paid to The Accelerate Louisiana Initiative foundation, and approximately $300 million will be paid to eligible members of the Blue Cross, or about $3,000 each.

It has been estimated that the pro-rata share of the purchase price if allocated to each member would be in the range of $35,000 to $40,000.

The remaining reserves of Blue Cross would be transferred to Elevance.

It must be understood that the Agreement and Plan of Acquisition do not spell out exact amounts to be paid or transferred. The amounts here are based on the best information which is publicly available.

The sale of Blue Cross to Elevance and the payments to Allevate Louisiana would result in the following:

•Blue Cross of Louisiana as we know it would no longer be a Louisiana business based in Louisiana. Elevance, a for-profit company, would be able to move its headquarters and offices anywhere. The nearly 3,500 Blue Cross of Louisiana employees would have no guarantees as to their future.

•The valuable asset which Blue Cross members currently have — an ownership interest in a multi-billion Louisiana company worth an estimated $35,000 to $40,000 per member — would be lost.

•A new foundation with $3.4 billion in assets would emerge, controlled by four members of the Blue Cross Board of Directors and whoever they choose to put on the Board. The assets would amount to 3,400 millions, making it one of the 25 largest foundations in the U.S.

•The new foundation currently has no assets, no history of raising or managing funds, or clear publicly available statement of its goals and purposes.

•Statements by the acting chairman, Mr. Barfield, indicate the foundation would focus on addressing health “inequality” in the state.

October 5, 2023

October 5, 2023

No comments yet... Be the first to leave a reply!