Policyholders Question Sale Of Blue Cross to For-Profit

By Woody Jenkins, Editor, Central City News – Baton Rouge

The proposed $2.5 billion sale of non-profit Blue Cross/Blue Shield to Elevance, an out-of-state, for-profit insurance giant, has been delayed by opposition from policyholders and legislators. The proposed transaction had smooth sailing until a letter announcing the sale was received by policyholders on August 15. Then “all hell broke loose”!

Blue Cross is a mutual company owned by the policyholders. It serves 1.9 million of Louisiana’s 4.4 million citizens and generally gets high marks from its insured. Roughly 84 percent of its revenues are paid out for medical providers, hospitals, and pharmaceuticals.

Most opposition to the sale has centered on these facts:

•Policyholders, almost all of whom are residents of Louisiana, would lose control of the 90-year-old mutual company. In turn, control would be turned over to an out-of-state, for-profit company.

•Policyholders would receive less than 9 percent of the $2.5 billion sale price of the company. More than 91 percent of the sale price of the company would be given to a foundation being formed by four members of the Blue Cross board of directors. Policyholders would have no control over that board.

•Policyholders would also lose their rights to more than $900 million in reserves of the company, much of which would also be turned over to the new foundation.

•Blue Cross has said the sale will result in thinning down expenses of the company but promised there will be no layoffs or rate increases. However, the language in the mailing sent to policyholders says there will be no layoffs or rate increases “during the current contract year.” The contract year ends Dec. 31.

•Blue Cross president/CEO Steven Udvarhelyi said he expects premiums paid by Blue Cross policyholders to increase by more than 8 percent next year, even without the sale of the business.

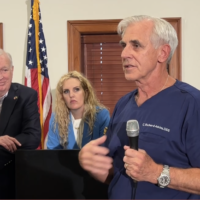

Shortly after the letter from Blue Cross arrived at the homes of policyholders, the Joint Legislative Committee on Insurance held a hearing on the proposal, which resulted in blistering criticism by some lawmakers.

Sen. Jeremy Stine (R-Lake Charles) said his office has been bombarded by constituents with questions about the sale. At the hearing, Sen. Stine said, “There’s one thing I agree with that I’ve heard today. It was when the president of Blue Cross said there is no need to do this today!”

Attorney Gen. Jeff Landry also raised questions and called for a delay in the approval process.

In the ensuring turmoil, State Insurance Commissioner Jim Donelon decided to delay a hearing he had set on the matter for August 21-22 to Oct. 5-6. Meanwhile, Blue Cross had already mailed out ballots to more than 90,000 policyholders with voting rights, asking them to send their proxies to the management team at Blue Cross.

Before the company could be converted from a non-profit mutual insurance firm to a for-profit stock corporation, two-thirds of Blue Cross policyholders would have to vote to approve the deal.

Meanwhile, in its mailing to policyholders, Blue Cross failed to provide policyholders with a fair description of the reasons to vote against the sale.

In addition, as the company attempted to secure votes in favor of the proposed sale, it used automated calls to policyholders which encouraged the policyholders to vote by punching Yes on their phone. However, this system provided even less information to policyholders and provided no safeguards to guarantee the sanctity of the votes cast.

Those votes have now been thrown out by Commissioner Donelon, and future voting has been delayed until Donelon holds a hearing on the proposal.

At a meeting of the Chamber of Commerce of East Baton Rouge Parish last week, Blue Cross spokesman Brian Keller said the sale was necessary in order to plan for the company’s future but in fact the company has revealed no such plan, other than selling out to insurance giant Elevance, formerly Anthem, which has 47 million policyholders.

In testimony before the Joint Legislative Committee on Insurance, New Orleans attorney Henry Kinney called the Blue Cross proposal “dishonorable” and “a usurpation of the rights of policyholders.”

Kinney said, “The board of Blue Cross is selling the assets that belong to the policyholders and offering to pay them $3,000 when they are worth over $30,000 per policyholder. Then they want to turn around and give that money to a self-appointed, self-perpetuating board of a new foundation. It was never their money to give! It belongs to the policyholders.”

“What information have they given us that this will benefit the policyholders? The ones promoting this sale are the members of the Board of Blue Cross, each of whom will get $1.05 million or more over the next 10 years under the terms of the deal,” Kinney said. “The chairman of the Board will get a minimum of $1.3 million over 10 years. How can these individuals render a neutral opinion about this sale? Yet, that’s who’s telling us this deal is good.”

Kinney said, “As far as giving $3.2 billion to four members of the Blue Cross board to form this new foundation, you will be making them some of the most powerful people in Louisiana.”

The public may testify at the hearing of the Commissioner of Insurance on Oct. 4-5 or file statements. If the Commissioner approves the sale, another vote of policyholders will be held. If two-thirds of the policyholders vote yes, the proposal will go back to the Commissioner for a second set of hearings.

August 31, 2023

August 31, 2023

No comments yet... Be the first to leave a reply!